Order Types Explained

To open a position of any kind in the forex market, you need to place an order. An order has all the relevant information about the position, like the position size, entry price, exit price, execution type and other.

In Forex/CFD trading, you are able to decide whether you go directly into the market, immediately open a position, or if you want to open a position only after certain price conditions are met. An order to open a position can have four different variants, each of which is solely dependent on the investor’s assessment of future price development.

Market Orders

A market order is executed immediately when placed. These are instant-execution orders, which means that you are buying or selling a currency instantly at current price. A market order immediately becomes an open position and subject to fluctuations in the market. This means that should the price move against you, the value of your position deteriorates and you incur a loss; of course it is important to remember that this is an unrealized loss until the order is closed. If the price in the meanwhile rebounds then your loss turns into profit.

- BUY Orders

The Buy Order states that you want to invest in a rising price. - SELL Orders

The Sell Order states that you want to invest in a falling price.

- STOP Orders

A STOP order has nothing in common with the similar sounding Stop-Loss Order. Stop orders become market orders only once certain conditions are fulfilled. You can use stop orders to buy above the market, or sell below the market.

A STOP Order essentially implies that you expect the existing trend of the price to continue after it reaches your order price. With a STOP Order, you believe that once a threshold has been reached, the trend will continue.

2. LIMIT Orders

LIMIT Orders, also have nothing in common with a Take-Profit Order and can only become active once certain conditions are met. A similarity with market orders is that limit orders can also be both buy limit order and sell limit orders. A LIMIT Order states, that when your order price is achieved there will be a reversal in the current trend.

With a LIMIT Order, you believe that once a price reaches a certain threshold, there will be a reversal in the trend. Generally, if you’d like to buy below the current market price, or sell above the current market price, a limit order would be the type of order to use.

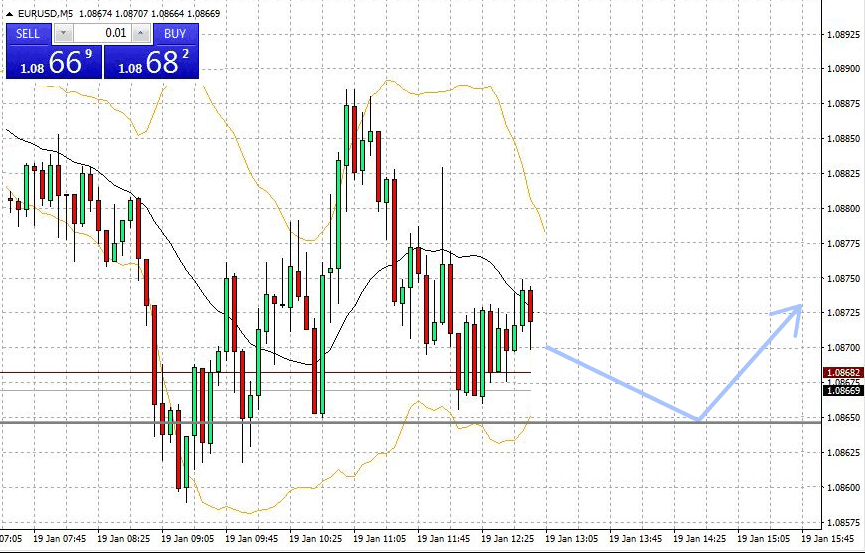

BUY-LIMIT

The current market price is above your entry price (Order Level).

If you believe that the market will fall to a certain level and then rise again, you should place a BUY-LIMIT order.

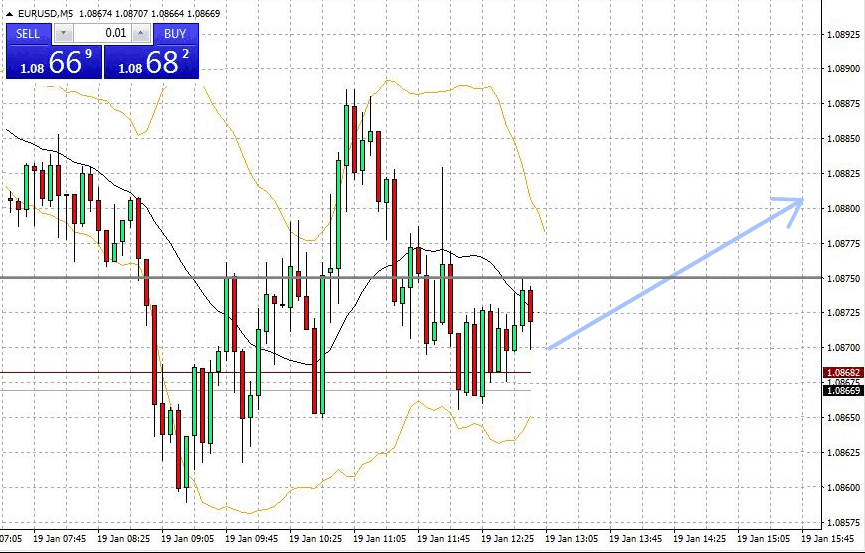

BUY-STOP

The current market price is under your entry price (Order Level).

If you believe that the market will continue to rise after it has reached a certain threshold, you should place a BUY-STOP order.

SELL-LIMIT

The current market price is below your entry price (Order Level).

If you believe that the market will rise to a certain level before falling again, you should place a SELL-LIMIT order.

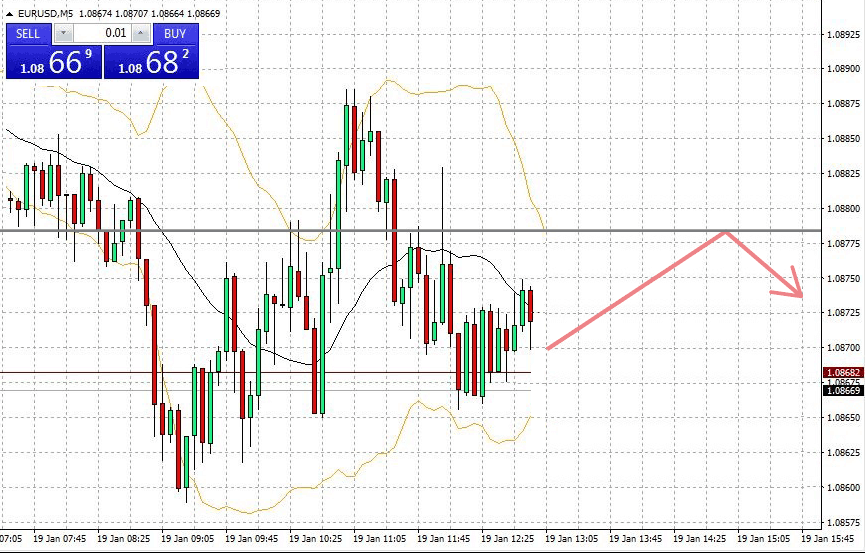

SELL-STOP

The current market price is above your entry price (Order Level).

If you believe that the market will continue to fall after a certain threshold has been reached, you should place a SELL-STOP order.