Position Features Explained

Forex and CFD trading is a leveraged product which means that if the markets move against your positions, your losses will be multiplied by the leverage ratio you have selected. Some traders opt to use a high leverage ratio as it can multiply their profits when the markets move to the direction they have placed their position on, but they should also be aware that a higher leverage ratio also translates to higher losses. When it comes to trading, it is therefore crucial to make sure you understand how to use the different tools at your disposal.

Leverage

When you buy a house, you often have to put a down payment and borrow the rest. The amount that you have borrowed is called leverage. The same applies to trading. If you wish to trade with a larger amount than that which you own, you set your leverage accordingly. The broker will typically offer different ratios of leverage raging from 1:50 to 1:1000. It is important to remember that the higher the leverage the higher your losses or profits will be. When using leverage, it is therefore important to understand that you are essentially increasing your risk. To keep you from opting from a higher leverage than what you can handle as a trader, BDSwiss administers an appropriateness test. If you lack the knowledge to use leverage appropriately, then you will be limited to a lower leverage ratio. But let’s get back to how leverage works…

In a currency transaction, if the leverage 1:50, then for every one euro of your own money, you are borrowing another 49 euros. Essentially, each one of your euros is multiplied by 50. So, if you open a position of €1000, using a 1:50 leverage you need to have at least €20 in your account balance. You are in essence putting down your €20 and borrowing another $980.

Margin

While leverage is the amount borrowed, margin is the amount put in – your money. Margin is the amount you are contributing to a certain trade and it is also the amount you stand to lose should the markets move against you. Going back to our previous example, that €20 you have invested, refers only to the “initial margin”. Margin is also the term used for the amount of money that you need to keep in your account to sustain a position; this is called the maintenance margin. This means that if you incur a loss greater than €20 you may still keep your position open but you will essentially be risking the rest of your available margin, in other words, your account balance, should the markets continue to move against you.

Eventually, if your position threatens to wipe your account clean, there will be a point where the position will be automatically closed, this is called a margin call, and this varies between brokers. Once you get a margin call and if you still would like to sustain your position open, the automatic closing of your position could be prevented by depositing more funds. If you are using MT4, the amount that you are still able to trade is often called “usable margin”, whilst the amount of your equity that is being used is often termed “used margin”.

Risk

Risk refers to the amount of money that you are risking. But as we have already explained, risk in forex trading is impacted by the amount of leverage and margin. In forex, high leverage can multiply any profits but it can also put your entire balance at stake. Risk management is therefore very important and as a trader you need to ensure that you are familiar with the risks involved in trading leveraged products such as Forex and CFDs.

Stop, Limit, Trailing Stop and Price Tolerance

When a trade goes wrong, there are only two options: to accept the loss and liquidate your position, or go down with the ship. A vigilant trader therefore, always provides their CFD positions with a stop and a limit. By not taking this step, you run the risk of remaining in a losing position for too long, in the hopes of a recovery, or not capitalizing on a profitable position in time.

It is crucial to remember to never leave an open CFD position unattended! If you are not able to constantly observe your open positions, it is vital that you set a stop and a limit level. This will protect you from any surprises that may occur.

You have the following options:

Stop-Loss – limit losses

If you want to place or edit a trade or order, you can define a Stop-Loss. This protects you from higher losses, as it automatically closes your position at the next available market price when it reaches the Stop Level. In essence a SL acts as insurance against losing too much. In order to work properly, a stop must be placed based on the following question: At what price is your opinion wrong?

To answer this question one must take into account the situation pertaining each trade. Is there a lot of volatility for example? Is it a long or short position? Is there important news that could have a major effect on your traded asset, coming up? What is the maximum percentage of price change beyond which you think the losses would exceed your risk tolerance? More importantly if you have multiple trades running, it is important to consider the overall risk you are taking with your SL orders. Worst case scenario, all your orders are stopped, what would be the overall loss? Would that be in line with your risk management strategy?

*Please note the applicable minimum point difference when placing a Stop-Loss Order.

Take-Profit – secure profits.

Following the same principle as a Stop-Loss level, you can also automatically book profits. A Take-Profit level can protect you from having a profitable trade change into a less profitable one or even a losing trade.

*Please note the applicable minimum point difference when placing a Take-Profit Order.

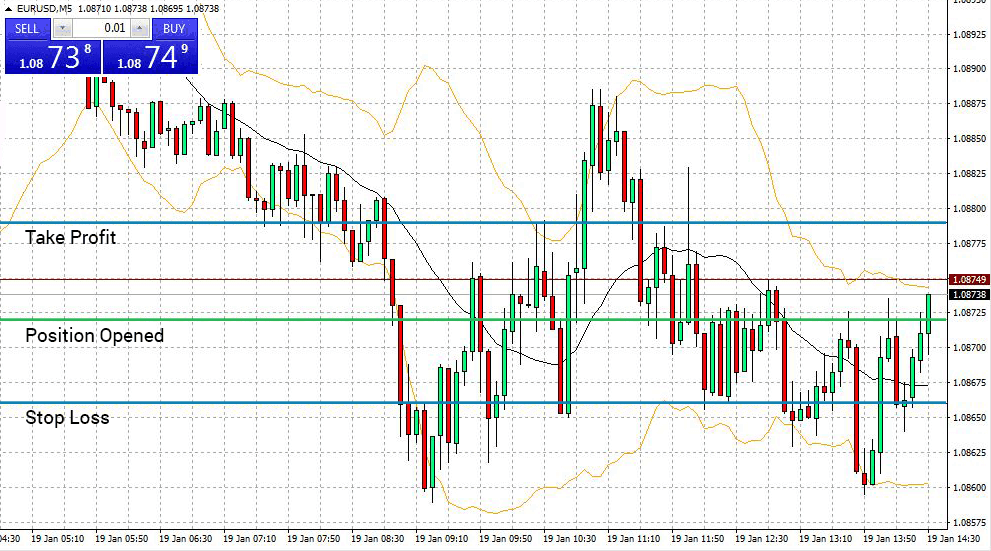

The following examples and graphics are for illustration purposes only and should not be considered as trading advice:

Example

You open a standard contract (Long) for the currency pair EUR/USD. As the chart shows, depending on the movement of the market, the position will automatically be closed if it reaches either the Stop or Limit Level.

This allows you to have an open position not requiring constant vigilance!

Trailing-Stop – following trends

With a Trailing-Stop you can benefit from ongoing trends. A reversal of the trend will, based on predefined criteria leading to an automatic closing of your position. You first determine a Stop Level, then with the help of a point specification (in terms of tenths of pips), you define how your Stop Level should modify itself.

Example

You open a standard contract (Sell) for the currency pair EUR/USD at the price of $1.08486 with a Stop-Loss of $1.08986 short, and with a Trailing-Stop of 50 points. The price falls by 50 points, which causes your new stop to be set at $1.08486. As long as the trend continues at this tempo, your Stop-Loss Level will be continually updated. A sudden rise in the EUR/USD will cause your position to be automatically closed.

Price Tolerance

When placing a direct trade on the market, volatility may cause a change in the starting price between placement and execution of the trade. The booked trading price could be detrimental to your trading strategy. To prevent this situation, there is Price Tolerance. With Price Tolerance you define, in terms of points, the maximum deviation between the current bid/ask price you would be willing to accept.

Example

The EUR/USD bid/ask price is currently trading at $1.08501/$1.08517. You want to give up a long position and are willing to accept a maximum price deviation of 5 points. Your trade will only be opened if the asking price is below $1.08522, otherwise the trade will be rejected by the system.