Weekly Outlook

75 or 100?

Early in June I wrote a weekly outlook, Is 50 the new 25? It looks like I was right – the European Central Bank (ECB) said in June that it would hike rates by 25 bps in July, and lo and behold! It hiked by 50 bps.

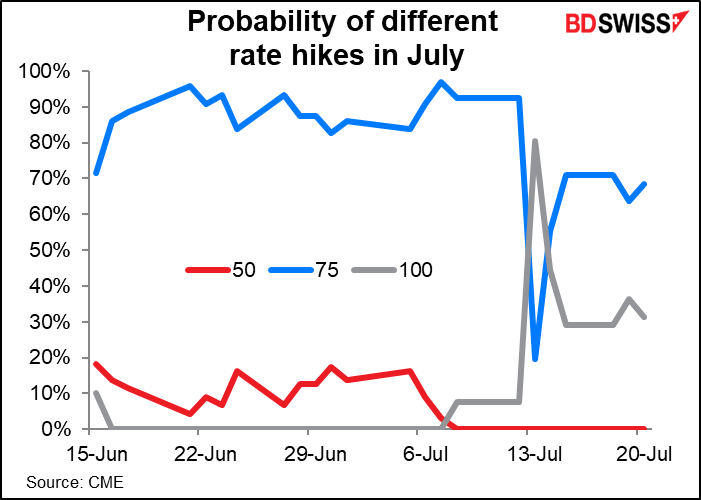

Now the question is, what will the rate-setting Federal Open Market Committee (FOMC) do when it meets on Wednesday? If we look at the probabilities derived from the fed funds futures, starting with the date of the June FOMC meeting, the betting has been on another 75 bps hike. The odds of a 100 bps hike spiked briefly but the likelihood has diminished recently.

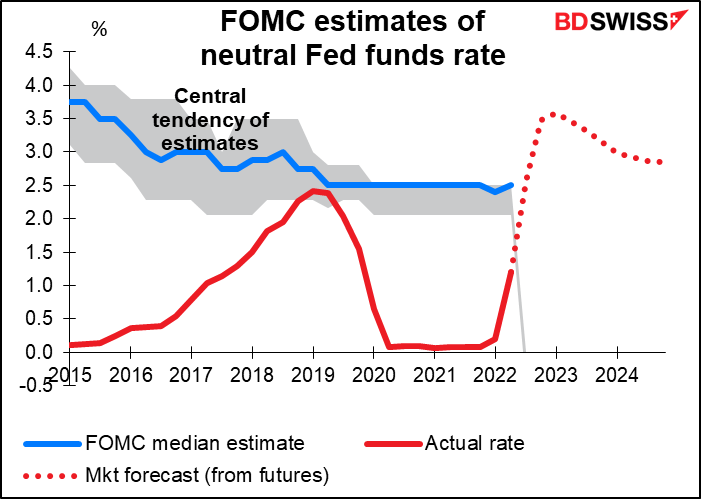

A 75 bps hike would bring the fed funds rate to 2.25%-2.50%, which is what the Committee members estimate is the longer-run level – i.e., the fabled “neutral” rate at which it is neither stimulating nor slowing the economy.

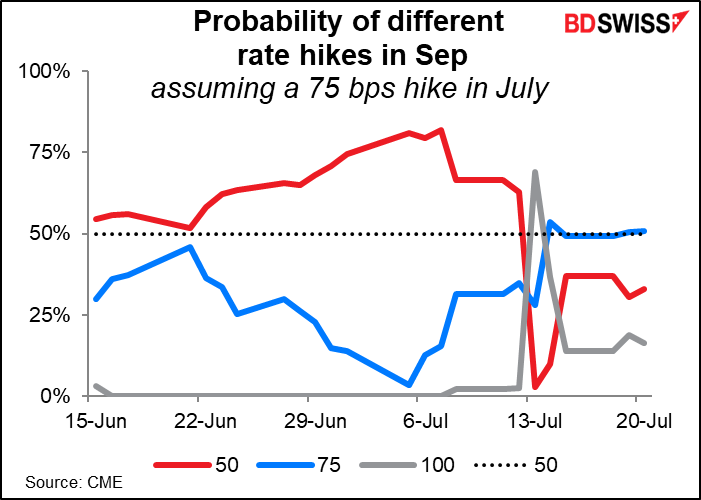

The big question after that is of course what guidance will they give about September and beyond? For the last several meetings they’ve said that the Committee “anticipates that ongoing increases in the target range will be appropriate.” The market currently has no strong view on September. It sees another 75 bps hike as a 50-50 proposition, with more likelihood (33%) of a 50 bps hike than a 100 bps hike (16%).

That would bring the fed funds rate clearly into restrictive territory. This is likely to be the major focus at the press conference: what forward guidance Fed Chair Powell can give about how far above the neutral rate they are willing to take rates. The futures market sees the fed funds rate peaking at 3.45% in January & February of next year.

The Fed is the only major central bank meeting during the week. There is however a lot of important data coming out, much of it concerning inflation and growth.

Inflation data: Australia releases its consumer price index (CPI) on Wednesday, Germany on Thursday, and the Eurozone on Friday. Also on Friday Japan releases the Tokyo CPI, Australia releases its producer price index, and the US announces the personal consumption expenditure (PCE) deflators. Let’s take them in the order in which we’ll encounter them.

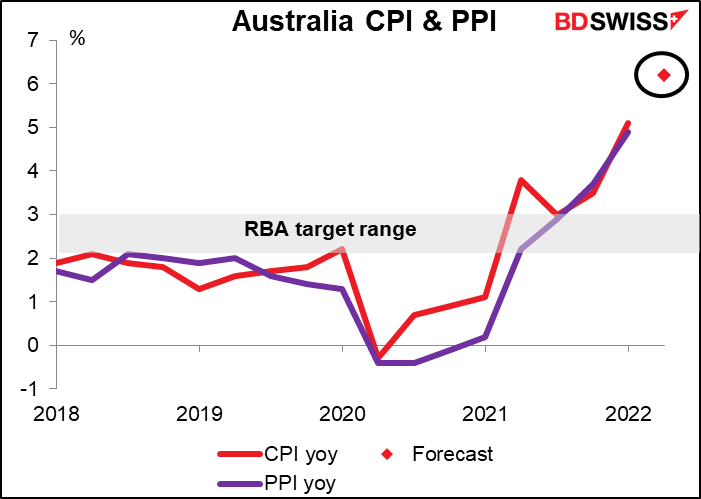

The Australia CPI is particularly important for that country because it only comes out quarterly. It’s expected to continue to rise, as is generally the case globally. Of particular note is that the quarter-on-quarter rate of growth in Q1 was 2.1% qoq, within the Reserve Bank of Australia’s 2%-3% target range for year-on-year growth, and is expected to be close to that this quarter too (1.9% qoq). We can only guess how they will like prices rising every three months as much as they wanted prices to rise every year. This is the CPI figure that the RBA will be discussing at their August, September, and October meetings (the next CPI comes out on Oct. 26th whereas the October RBA meeting is on the 4th).

There’s no forecast yet for the producer price index (PPI), which, unusually, is below the CPI (4.9% yoy vs 5.1% yoy, respectively). Given that in most other countries it’s way, way above – Germany for example the PPI is 32.7% yoy vs 8.2% for the CPI – I’d say there’s a good chance we see the Australian PPI leap higher.

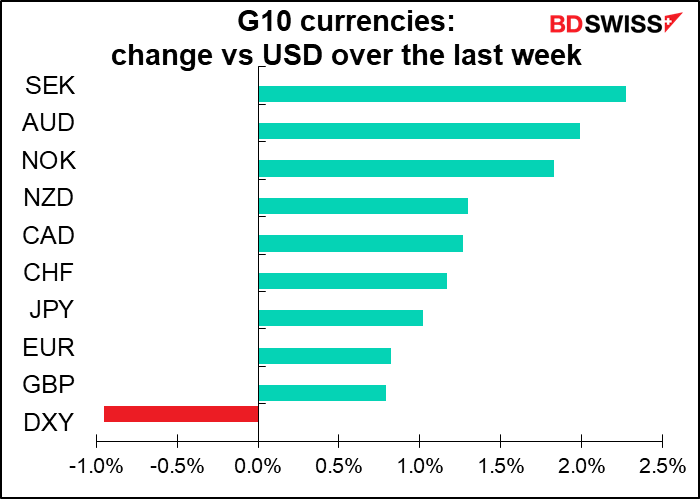

All told with rising inflation and a general recovery in risk sentiment we may see AUD move higher next week.

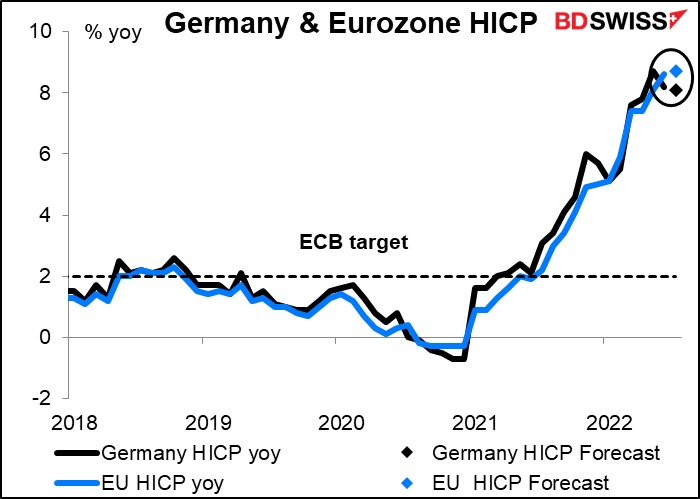

Eurozone inflation is expected to be little changed. The German harmonized index of consumer prices (HICP) is forecast to be down 10 bps to 8.1% yoy while the Eurozone-wide figure is forecast to be up 10 bps to 8.7% yoy. Does this mean inflation is peaking in the Eurozone? If so it could reduce bets on another 50 bps hike in rates at the ECB’s September meeting, which would be negative for EUR.

The Tokyo CPI is expected to creep higher by 10 bps. Such a sluggish rise would only confirm the Bank of Japan’s view that inflation isn’t sustainably over its 2% target and justify the BoJ’s decision not to change policy at all. This would be yet another green light to sellers of JPY (buyers of USD/JPY).

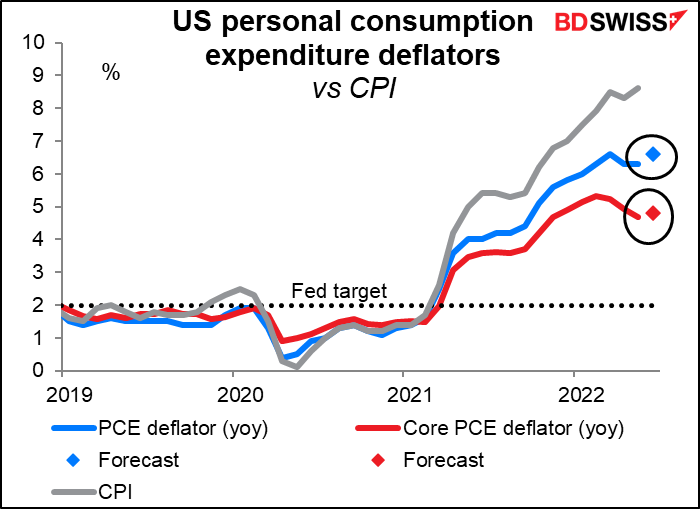

The US personal consumption expenditure (PCE) deflators are in theory the Fed’s preferred inflation gauges and the ones that they forecast every quarter in their Summary of Economic Projections. Yet the fact is that when talking, Committee members usually refer to the CPI, not the PCE deflators, and so the market treats these as second-tier data. Nonetheless they’re likely to be worrisome: the headline figure is expected to rise 0.3 percentage point, same as the rise in the CPI during the month, and the core figure, the more important of the two, by 0.1 ppt.

What’s the cumulative impact of these figures likely to be? The signal to the market is likely to be that inflation hasn’t peaked yet. It’s still heading higher. That means central banks are likely to tighten further. The news could erode some of the “risk-on” sentiment, which would be good for USD but damaging for the commodity currencies (unless people think Australian inflation is high enough to force the RBA to tighten much further).

Meanwhile, let’s look at growth. We have Q2 GDP data coming out from the US (Thu) and Germany & the EU (Fri), as well as Canada’s May GDP.

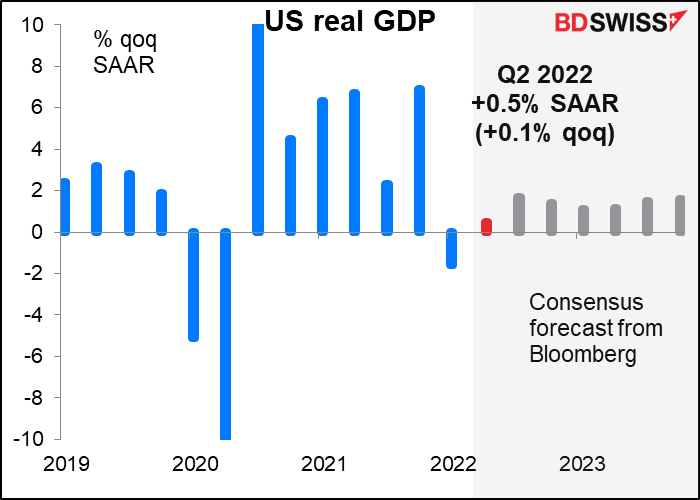

The US is expected to register moderate growth of +0.5% qoq on a seasonally adjusted annualized basis (+0.1% qoq the way the rest of the world calculates it). That would avoid a technical recession of two consecutive quarters of economic contraction (I refuse to write “negative growth”). Estimates range from the Atlanta Fed’s GDPNow doleful estimate of -1.6% qoq SAAR to the St. Louis Fed’s astronomical +4.1% estimate. I think a positive result, avoiding a technical recession, would be well received and could boost the dollar as it would encourage the Fed to think they could keep hiking rates without causing a recession.

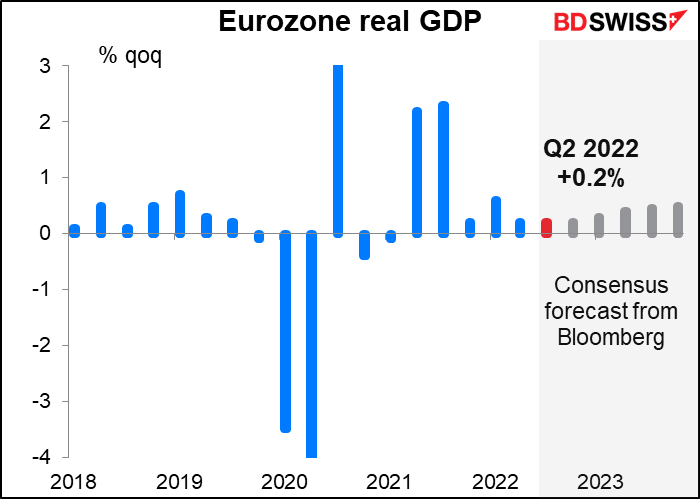

The Eurozone is forecast to grow 0.2% qoq. That’s faster than the US (which as mentioned above is expected to grow only 0.1% qoq). But US growth is expected to accelerate later this year (0.4% qoq and 0.3% qoq in Q3 and Q4, respectively) while the Eurozone is expected to plod along at +0.2% qoq for the rest of the year.

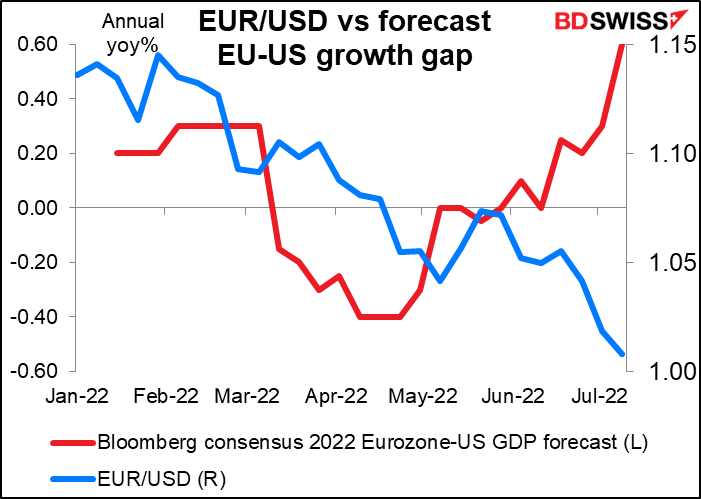

Nonetheless Eurozone growth for the year as a whole is expected to outpace US growth. In theory that should support EUR somewhat, but it doesn’t seem to be helping much, probably because stronger growth isn’t translating into higher interest rates.

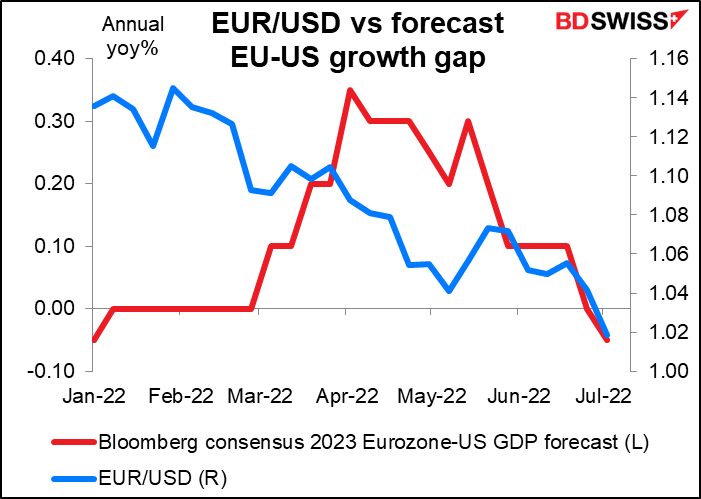

For next year however it’s another story. Recently Eurozone growth estimates have been downgraded faster than US growth estimates as forward European energy prices soar. It’s unclear to me though how far in advance the FX market is discounting growth differentials or even if it’s discounting them at all – EUR/USD doesn’t seem to be tracking these growth forecasts except perhaps by coincidence.

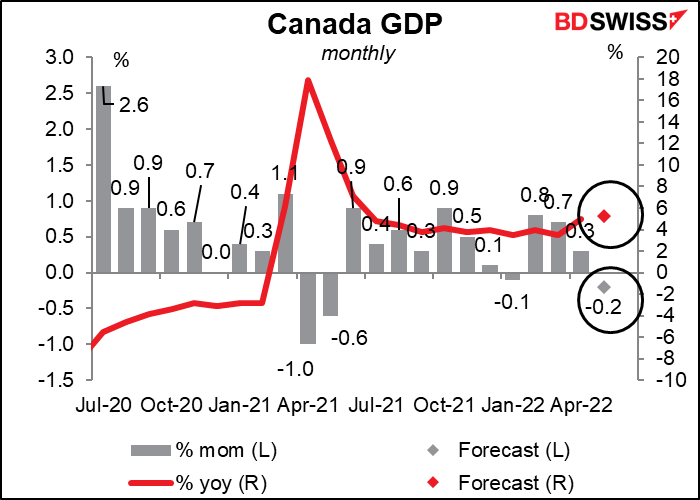

Canada’s GDP is expected to decline 0.2% month-on-month in May, but even so, the year-on-year pace of growth is forecast to rise to 5.3% from 5.0%. That would put output 2.1% above the pre-pandemic level. I don’t think this would give the Bank of Canada any cause to pause. The Bank said it expects growth of 3 ½% yoy this year and this number wouldn’t necessarily push the economy off course from that. Accordingly I think it’s likely to be neutral for CAD.

Other important US indicators coming out during the week include: Conference Board consumer confidence and new home sales (Tue); durable goods and wholesale & retail inventories (Wed); and along with the PCE deflators Friday, personal income & savings.

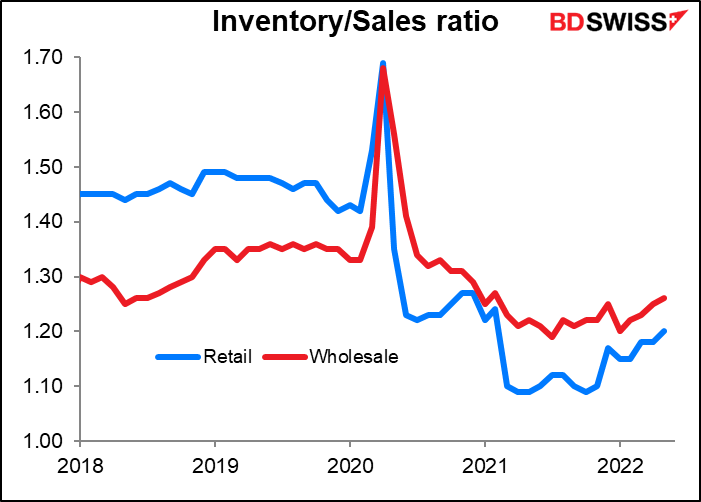

I don’t usually cover the inventory data because normally it isn’t of direct interest to the FX market. But recently I’ve been seeing a lot of articles on how retailers are stuck with excessive inventories – inventories up 40% or more from a year ago – and are having to slash their buying and put on sales to get inventories down.

Oddly enough though I don’t see it in the data – at all. The inventory/sales ratios at both the wholesale and retail levels are well below the pre-pandemic level. I’ll still be watching this data though as it may be the key to solving the inflation problem.

From Japan we’ll also get the minutes of the June Bank of Japan meeting (Tue) and the employment data and industrial production figures (Fri). Normally the BoJ minutes are of little interest since the Policy Board never decides to do anything anyway, but this time around it’ll be interesting to read exactly why they decided not to do anything. Ahead of this meeting there was intense speculation that they would change their yield curve control (YCC) program and free up the 10-year bond yield to rise in order to narrow the yield gap with other countries, but they didn’t do any such thing. Perhaps the minutes will shed some light on their thinking.

In the Eurozone we’ll also get the Ifo indices (Mon) and German unemployment (Fri).

Australia releases its retail sales (Thu) and private-sector credit (Fri).

And it’s a pretty dull week for the UK with only one significant indicator, mortgage approvals (Fri)!