Market Analysis Review

BoC cuts rates by 25bps, EURUSD rises 0.35%, Focus shifts to US ADP data

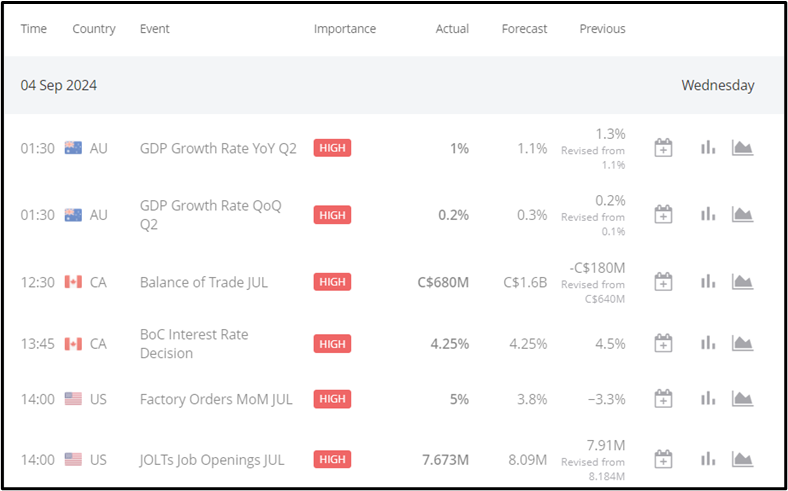

Previous Trading Day’s Events (04.09.2024)

Australia GDP Growth Rate: The Australian economy expanded by 0.2% QoQ in Q2 2024, missing forecasts of 0.3%. This marks the 11th consecutive quarter of growth, though the pace slowed, driven by a 1.4% increase in government spending, up from 1.2% in Q1.

Australia Annual GDP Growth: GDP grew by 1% YoY in Q2 2024, the slowest annual rate since Q4 2020.

Canada Balance of Trade: Canada posted a trade surplus of CAD 0.68 billion in July 2024, the first surplus since February, missing expectations of CAD 0.85 billion after a revised deficit of CAD 0.18 billion in June.

Canada Interest Rate: The Bank of Canada cut its benchmark rate by 25bps to 4.25% in September 2024, the third consecutive cut after holding rates at a terminal 5% for 10 months.

US Job Openings: Dropped by 237K to 7.673M in July 2024, marking the lowest level since January 2021, and missing forecasts of 8.10M.

US Factory Orders: Rose by 5% to $592.1B in July 2024, exceeding expectations and recovering from a 3.3% decline, indicating economic resilience.

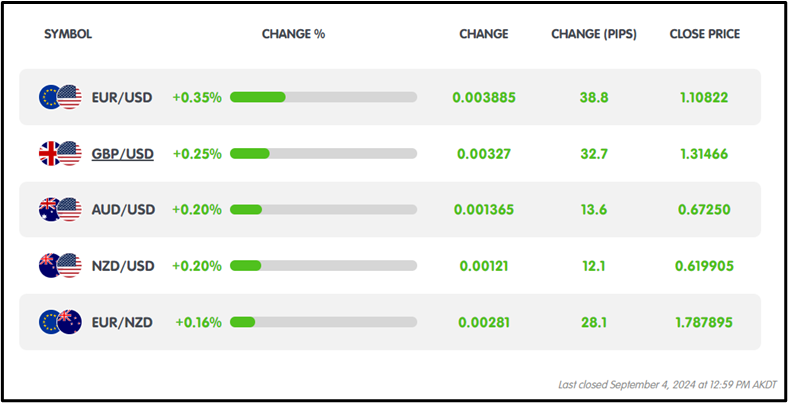

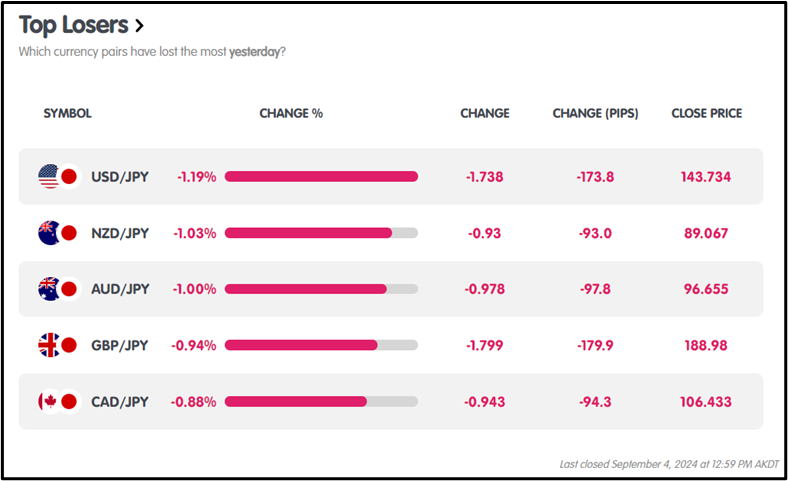

Winners and Losers In The Forex Market

On September 4, 2024, in the forex market, EURUSD led the gains with a +0.35% move and an advance of +38.8 pips, while USDJPY lagged as the biggest loser, sliding -1.19% and shedding -173.8 pips.

On September 4, 2024, in the forex market, EURUSD led the gains with a +0.35% move and an advance of +38.8 pips, while USDJPY lagged as the biggest loser, sliding -1.19% and shedding -173.8 pips.

News Reports Monitor – Previous Trading Day (04.09.2024)

Server Time / Timezone EEST (UTC+03:00)

Tokyo Session: AUD bullish with Q2 2024 QoQ GDP growth at 0.2% (below 0.3% forecast) and YoY growth at 1% (slowest since Q4 2020).

Tokyo Session: AUD bullish with Q2 2024 QoQ GDP growth at 0.2% (below 0.3% forecast) and YoY growth at 1% (slowest since Q4 2020).

London Session: No Significant News.

New York Session:

CAD bearish with a July trade surplus of 0.68B, missing the 0.85B forecast.

Bullish CAD with BoC cutting rates by 25bps to 4.25%, marking the third consecutive cut.

Bearish USD with job openings dropping 237K to 7.673M, missing 8.10M forecast.

Bullish USD with factory orders rising 5% to $592.1B, surpassing expectations.

General Verdict:

FOREX MARKET MONITOR

EURUSD (04.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

EUR/USD exhibited bullish momentum, opening at 1.10345, hitting a high of 1.10945, and closing stronger at 1.10819, with the daily low at 1.10343.

CRYPTO MARKET MONITOR

CRYPTO MARKET MONITOR

BTCUSD (04.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

BTCUSD showed a bearish trend, opening at $58,209.61, peaking at $58,561.44, and hitting a low of $55,611.43 before closing lower at $57,977.03.

STOCKS MARKET MONITOR

STOCKS MARKET MONITOR

NETFLIX (04.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

Netflix showed bullish momentum, opening at $675.40, rallying to an intraday high of $684.64, dipping to a low of $672.97, and closing strong at $679.40.

INDICES MARKET MONITOR

INDICES MARKET MONITOR

US30 (04.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

US30 showed a bullish trend, opening at 40,968.70 and closing higher at 40,997.53, with an intraday peak of 41,237.03 and a low of 40,823.

COMMODITIES MARKET MONITOR

COMMODITIES MARKET MONITOR

USOIL (04.09.2024) 15m Chart Summary

Server Time / Timezone EEST (UTC+03:00)

Price Movements

USOIL traded bearish, opening at $69.816 and closing lower at $68.724, with intraday movements hitting a low of $68.331 and peaking at $70.930.

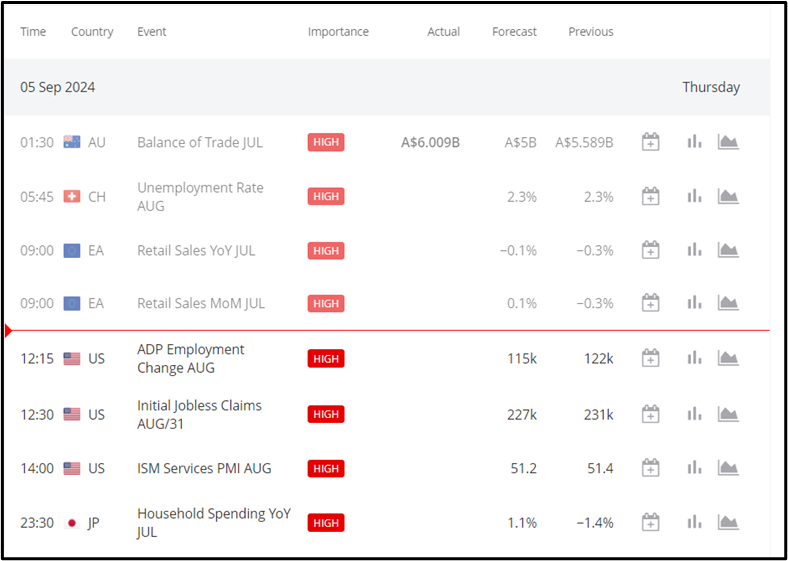

News Reports Monitor – Today Trading Day (05.09.2024)

News Reports Monitor – Today Trading Day (05.09.2024)

Tokyo Session:

Tokyo Session:

01:30 AU Trade Balance (Jul) Actual A$6.009B vs. Forecast A$5B. Bullish AUD when news was released at 1:30 am GMT.

05:45 CH Unemployment Rate (Aug) Forecast 2.3%. A lower actual could strengthen CHF.

London Session:

09:00 EA Retail Sales YoY (Jul) Forecast -0.1%, MoM Forecast 0.1%. Higher-than-expected readings may strengthen EUR.

New York Session:

12:15 US ADP Employment Change (Aug) Forecast 115k. Higher-than-expected readings may strengthen USD.

12:30 US Jobless Claims (Aug) Forecast 227k. Lower-than-expected readings may strengthen USD.

14:00 US ISM Services PMI (Aug) Forecast 51.2. Higher actuals could boost USD.

General Verdict :

Sources :

Metatrader 4 ( MT4 )